"Estándares Internacionales de Protección al Cliente" - Viernes 9 de Diciembre

- Información y registro: https://conta.cc/3E8bNXj

"Desempeño del Sector Microfinanciero en el 2022 y Expectativas 2023" - Viernes 25 de Noviembre

- Información y registro: https://conta.cc/3UfnjFP

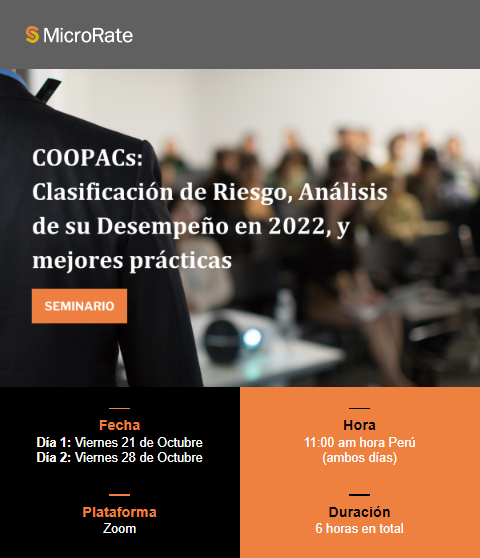

"COOPACs: Clasificación de Riesgo, Análisis de su Desempeño en 2022 y mejores prácticas" - Viernes 21 y 28 de Octubre

- Información y registro: https://conta.cc/3rO08G8

International Seminar "Social Performance Management for Financial Institutions"

Date: September 30

Time: 3:00 pm (UTC+1)

Platform: Zoom

Duration: 3 hours

Speaker: Pamela Gómez, Senior Analyst

Economist with a Master’s in Finance, Banking, Risk and Investment Funds. She has led rating missions in microfinance institutions of different sizes and credit methodologies in Latin America, as well as in the Spanish, English and French-speaking Caribbean. Additionally, she has participated in missions in Africa and Central Asia.

Themes:

- Institution’s social orientation

- Formalization of processes

- Key aspects of mission deployment

- Relevant factors for measuring responsible finance

- Corporate Social Responsibility

- Understanding the benchmark in SPM (examples of indicators)

- ESG (environmental, social and governance)

Investment:

EARLY PAYMENT Until Sep. 23

USD 180 p/person

REGULAR PRICE From Sep. 24 to 30

USD 250 p/person

After you have completed your registration, we will contact you to provide you with more information and make payment arrangements.

International Seminar "Integrated Risk Management in Microfinance Institutions"

Date: August 26

Time: 3:00 pm Nigeria (UTC+1)

Platform: Zoom

Duration: 3 hours

Speaker: Pamela Gómez, Senior Analyst

Economist with a Master’s in Finance, Banking, Risk and Investment Funds. She has led rating missions in microfinance institutions of different sizes and credit methodologies in Latin America, as well as in the Spanish, English and French-speaking Caribbean. Additionally, she has participated in missions in Africa and Central Asia.

Themes:

- CONCEPTUAL FRAMEWORK

- CREDIT RISK

- OPERATIONAL RISK

- FINANCIAL RISK

- BEST PRACTICES

Investment:

EARLY PAYMENT Until Aug. 22

USD 180 p/person

REGULAR PRICE From Aug. 23 to 26

USD 250 p/person

After you have completed your registration, we will contact you to provide you with more information and make payment arrangements.

|

|

MicroRate estará presente en México del 31 de Agosto al 2 de Septiembre para la 16ava Convención de ASOFOM.

Si su institución también asistirá, agendemos una reunión presencial

MicroRate will be present in São Paulo on April 27th and 28th on the occasion of Abcred's 20th anniversary. We would like to take this opportunity to meet with your microfinance institutions (MFIs) for an exchange of experiences and an update on our entities.

Our representatives who will be present:

|

|

We would like to schedule a meeting with your microfinance institution: info@microrate.com

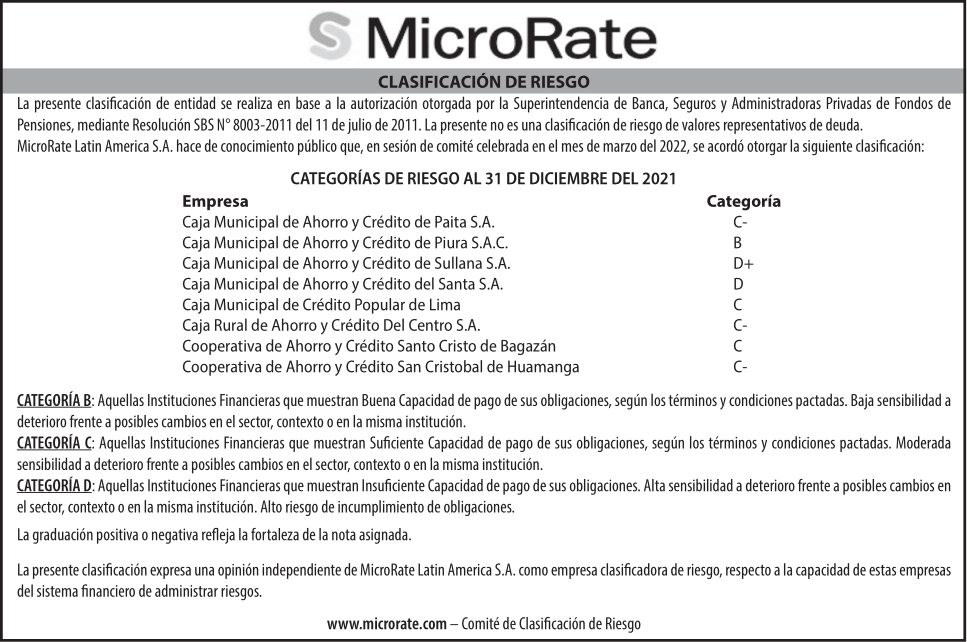

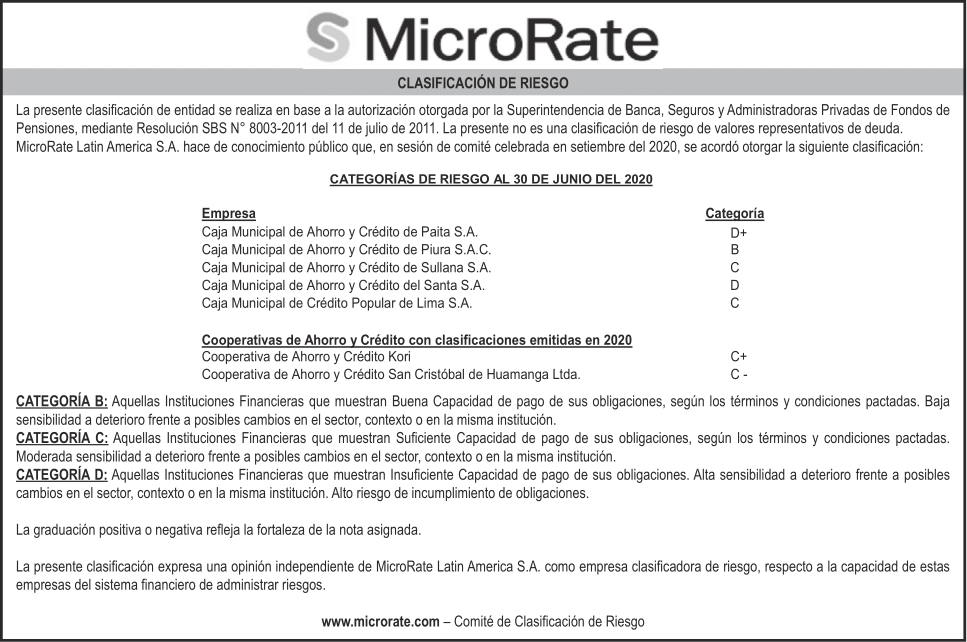

We publicly share MicroRate's risk ratings for Peruvian MFI's as of December 2021.

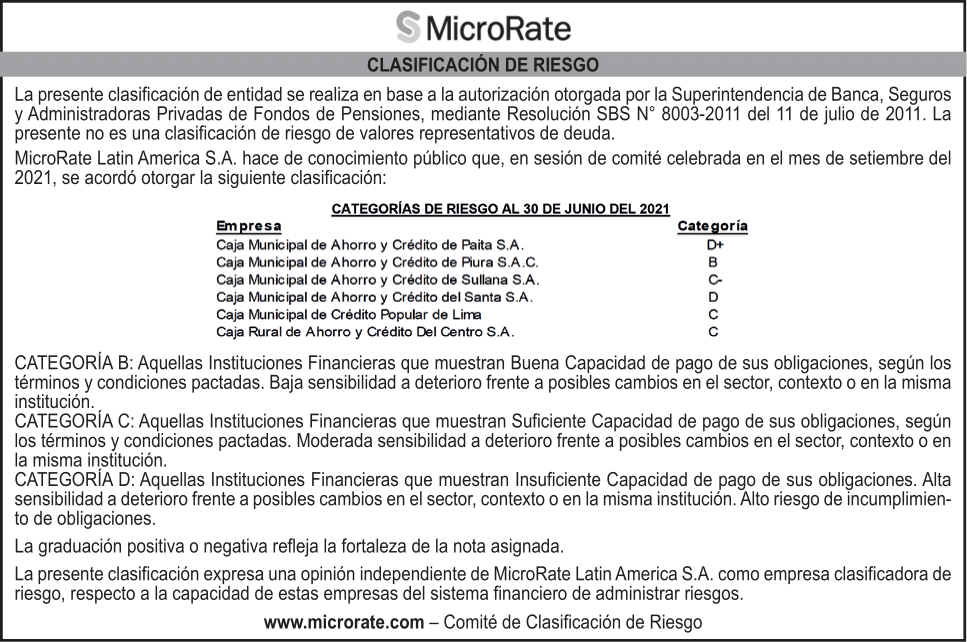

We publicly share MicroRate's risk ratings for Peruvian MFI's as of June 2021.

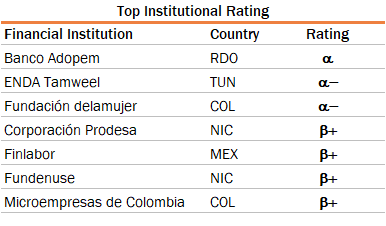

As every year, we want to publicly announce the global lists of those entities that achieved excellence in 2 different categories: Social Performance and Institutional Performance.

On Thursday 18th we officially presented the lists in an event, watch the recording by clicking here.

The following institutions were listed in alphabetical order for each grade. The lists include only institutions with public grades that were rated during 2021.

MicroRate congratulates all of these entities for the remarkable effort in terms of Institutional and Social Performances, even in the face of an adverse context in the places where they operate, without losing focus on their mission towards financial inclusion.

We invite them to continue demonstrating that a financial-social balance is possible.

MicroRate is pleased to announce that Caja Municipal Ahorro y Crédito de Piura (CMAC PIURA) obtained a Social Rating of 3.5 (three and a half) stars with a Stable outlook, thus entering the rank of international excellence.

Caja PIURA is so far the only Caja Municipal in Peru to obtain this achievement and places it among the top microfinance institutions worldwide in Social Performance Management.

MicroRate congratulates CAJA PIURA's team for the remarkable effort in terms of Social Performance, which evidences its commitment to its clients, employees, the community and the environment.

After a year full of challenges for Microfinance Institutions (MFIs), we want to publicly recognize in presence of the various actors of the Microfinance Sector, those MFIs rated by MicroRate that had superior financial, social, and institutional performances even in the face of an adverse context in the localities where they operate without losing focus on their mission towards financial inclusion.

We cordially invite you to attend this live event where we will have the participation of the entities that achieved excellence in 2 categories: Social Performance and Institutional Performance, where they will share their experience of how 2021 was for them and the best practices that led to their outstanding performance.

Please register here if you want to participate: https://us02web.zoom.us/webinar/register/WN_k8wU7EEuSryoGpEmfBGp5A

MicroRate has been officially acknowledged as rater for Microfinance Institutions under the authority of Le Gouverneur de la Banque Centrale de Tunisie (Central Bank of Tunisia) in accordance with the Circular Note N°2020-13.

MicroRate's CEO, Maria Belen Effio stated, “We look forward to contributing to Tunisie's financial inclusion (Microfinance) sector by providing independent and objective assessments.”

"Corporate Governance and its role in Sustainable Development"

Event organized by CAF and MicroRate, aimed at Directors and Senior Management of Latin American MFIs. Spanish language presentation.

MicroRate will continue to issue the certification of MFIs under its label, framed within the standardized methodology of SPTF and CERISE.

In order to keep the main actors of the Microfinance Sector informed, information was gathered on what is happening inside the MFIs, the internal and external factors that influence their current operations as well as their short and medium term perspectives.

Read the report here.

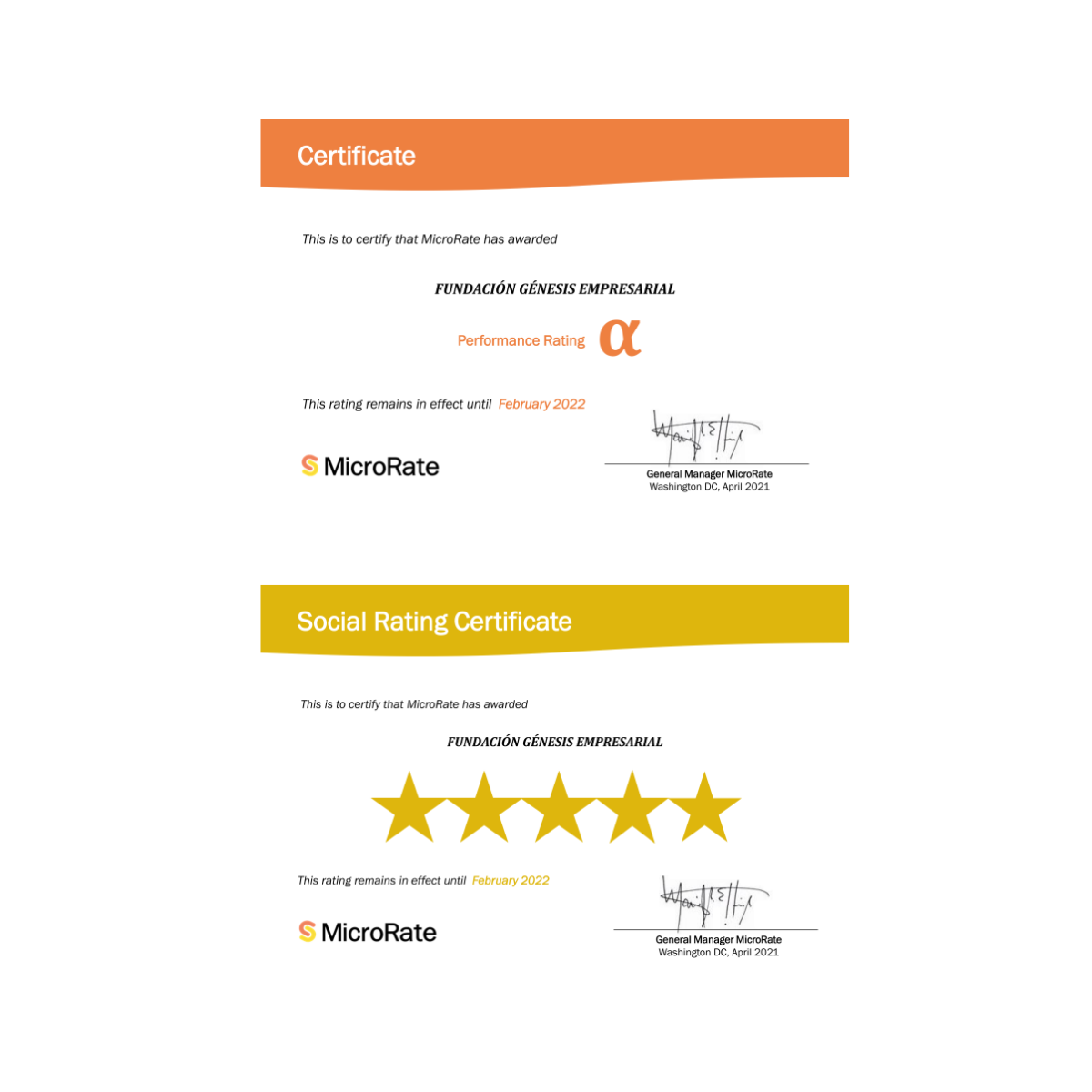

This certification recognizes that Coocique R. L., Crezcamos S.A. and Fundación Génesis Empresarial meet global standards in Client Protection Principles through their operations, product offerings and customer service. It is also a sign of their commitment to keep its clients at the center of its work, contributing to a responsible financial sector.

Link to the official news and certificate: Coocique R. L.

Link to the official news and certificate: Crezcamos S.A.

Link to the official news and certificate: Fundación Génesis Empresarial

In complex scenarios such as the current one, Fundación Génesis Empresarial has been able to maintain its Institutional Performance, once again achieving an Alpha ("α") rating and even improving its outlook from Stable to Positive.

In Social Performance, MicroRate ratified its maximum score on the 5-Star rating scale, which, in the history of MicroRate, has only been achieved by two entities worldwide.

We congratulate Fundación Génesis Empresarial and its entire team for this excellent result!

Full story: https://conta.cc/3dJQWMZ

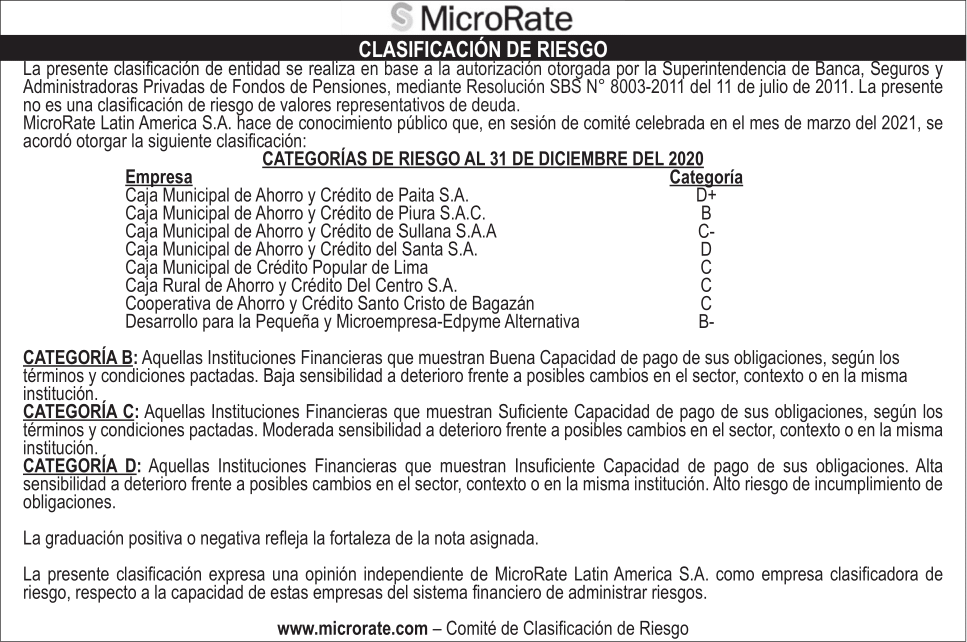

Following the stablishments contained in Financial System General Law (N° 26702) and SBS Resolution N° 18400-2010, Regulation for Financial and Insurance Companies Ratings, MicroRate presents to the market the ratings that were assigned to our clients, with data as of December 2020.

In the last interview that the portal Microfinanzas.pe conducted with our General Manager Maria Belen Effio, it was stated that out of every 10 loans refinanced by the Covid-19 pandemic in the region, approximately 3.6 would not repay the loan according to MicroRate's regional estimate.

Available in Spanish (Link)

MicroRate is pleased to announce the names of those financial institutions that obtained or revalidated their Client Protection Principles Certification, The Smart Campaign, after a strict evaluation process of their compliance of each with each Principle.

Kindly find the report here.

MicroRate is pleased to announce the financial institutions (FI) that obtained the best international grades in Institutional Performance Rating (MIR) and Social Performance Rating during the crisis context due to the Covid-19 pandemic. The list includes regulated and non-regulated entities.

Kindly find the report here.

RESULTS AS OF JUNE 2020

Information processed and standarized on MFIs rated by MicroRate.

This special report shows around 30 KPIs of the most relevant ratios under this particular context, among them:

- Rescheduled Loans

- Disbursements

- Collections

- Liquidity

- PAR 30 and Adjusted PAR 30

- Funding Structure

- Operational Sufficiency

If you are interested in receiving this report, please contact us at info@microrate.com

RESULTS AS OF JUNE 2020

This report contains a comparative chart with the most relevant ratios as Productivity, Efficiency, Profitability, and more.

If you are interested in receiving this report, please contact us at info@microrate.com

Following the stablishments contained in Financial System General Law (N° 26702) and SBS Resolution N° 18400-2010, Regulation for Financial and Insurance Companies Ratings, MicroRate presents to the market the ratings that were assigned to our clients, with data as of June 2020.

Following the stablishments contained in Financial System General Law (N° 26702) and SBS Resolution N° 18400-2010, Regulation for Financial and Insurance Companies Ratings, MicroRate presents to the market the ratings that were assigned to our clients, with data as of December 2019.

See our announcement individually exposed here.

Following the stablishments contained in Financial System General Law (N° 26702) and SBS Resolution N° 18400-2010, Regulation for Financial and Insurance Companies Ratings, MicroRate presents to the market the ratings that were assigned to our clients, with data as of September 2019.

See our announcement individually exposed here.

Lima. October 31st, 2019. MicroRate is pleased to announce the financial institutions (FI) that obtained the best international grades in institutional rating (MIR) and social rating. The list includes regulated and non-regulated entities.

The MIR evaluates the overall performance regarding the best practices and sustainability in the long term. Furthermore, we are also pleased to recognize the effort in the social performance management, which confirms the responsibility of these FI towards their customers, employees, the community and the environment. See press release

Lima, September 2017. – We are pleased to present the financial institutions (FI) that, following a rigorous evaluation process, obtained the Certification by MicroRate in the International Client Protection Principles.

Congratulations to all the FI for these achievements which confirm their commitment to keeping clients at the heart of their work.

See the complete Press Release here.

Lima, September 2017. MicroRate is pleased to present the financial institutions (FI) that obtained the best international grades in institutional rating (MIR) and social rating. The list includes regulated and unregulated entities from different countries.

The MIR evaluates the overall performance regarding the best practices and sustainability in the long term. We are also pleased to recognize the effort in the social performance management, which confirms the responsibility of these FI towards their customers, employees, the community and the environment. See press release

ENDA Tamweel of Tunisia is the first microfinance institution rated by MicroRate at the maximum score of the social scale, 5 Stars, demonstrating exceptional levels in social performance. Read More

While the placement of microcredits in a group expresses the essence of microfinance by its attention to the base of the pyramid, it may be the placement mechanism that is most exposed to operational as well as reputational risk.

In the experience of MicroRate, the operational risk in group methodology is furthered when the regulation of the group’s operations is imprecise. There is a high level of manipulation of cash (in disbursement and collection sessions), a relaxation of credit policies and, in general, insufficient control. To this is added a comparatively higher turnover of loan officers, which is explained, in part, by the challenge they face to serve groups in dispersed and inaccessible localities. Read More

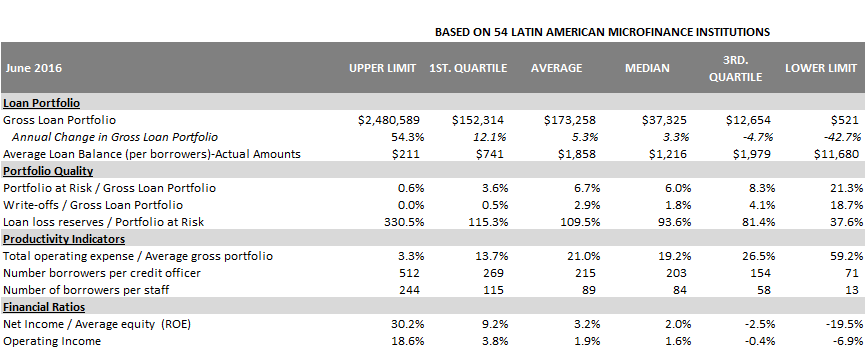

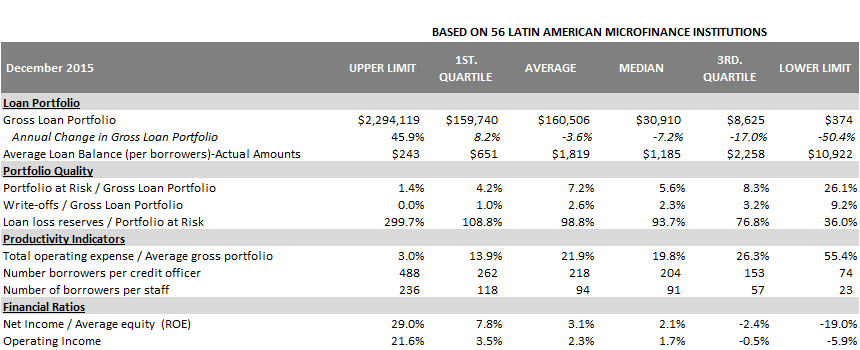

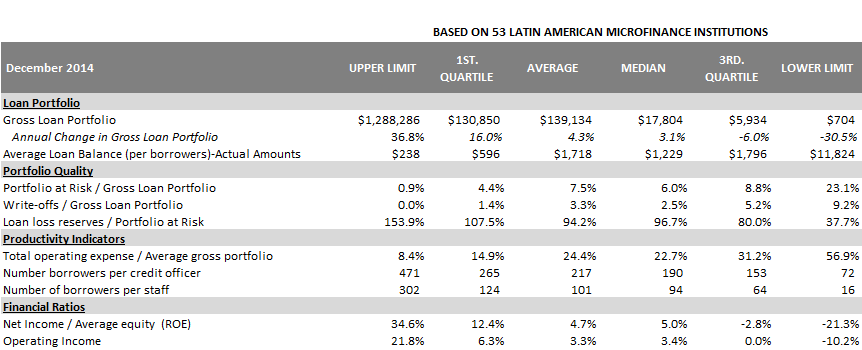

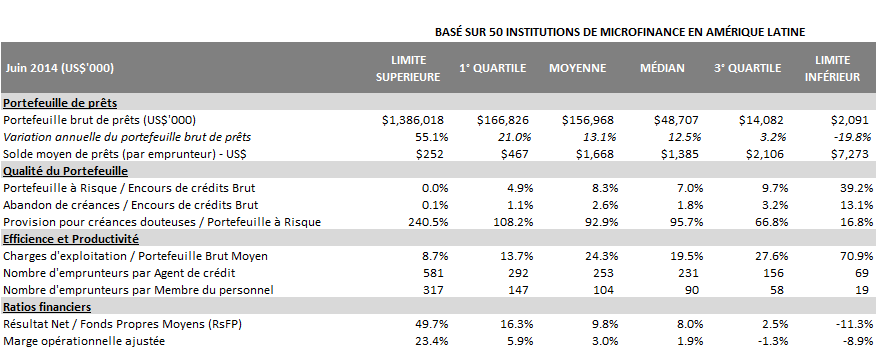

The MicroRate Benchmark, developed more than 13 years ago, is generated on the basis of half-yearly information from at least 50 financial institutions rated by MicroRate.

Our rated customers receive the complete report with a compendium of over 30 key management indicators, segmented according to the size of the MFI, credit methodology, etc.

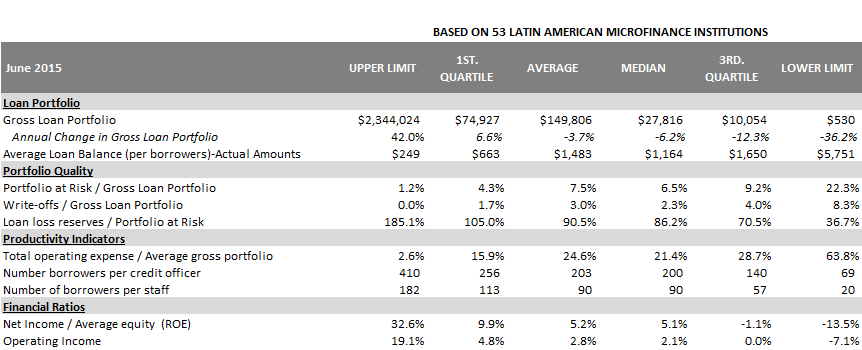

The MicroRate Benchmark, developed more than 13 years ago, is generated on the basis of half-yearly information from at least 50 financial institutions rated by MicroRate.

Our rated customers receive the complete report with a compendium of over 30 key management indicators, segmented according to the size of the MFI, credit methodology, etc.

The MicroRate Benchmark, developed more than 13 years ago, is generated on the basis of half-yearly information from at least 50 financial institutions rated by MicroRate.

Our rated customers receive the complete report with a compendium of over 30 key management indicators, segmented according to the size of the MFI, credit methodology, etc.

The MicroRate Benchmark, developed more than 13 years ago, is generated on the basis of half-yearly information from at least 50 financial institutions rated by MicroRate.

Our rated customers receive the complete report with a compendium of over 30 key management indicators, segmented according to the size of the MFI, credit methodology, etc.

The MicroRate Benchmark, developed more than 13 years ago, is generated on the basis of half-yearly information from at least 50 financial institutions rated by MicroRate.

Our rated customers receive the complete report with a compendium of over 30 key management indicators, segmented according to the size of the MFI, credit methodology, etc.